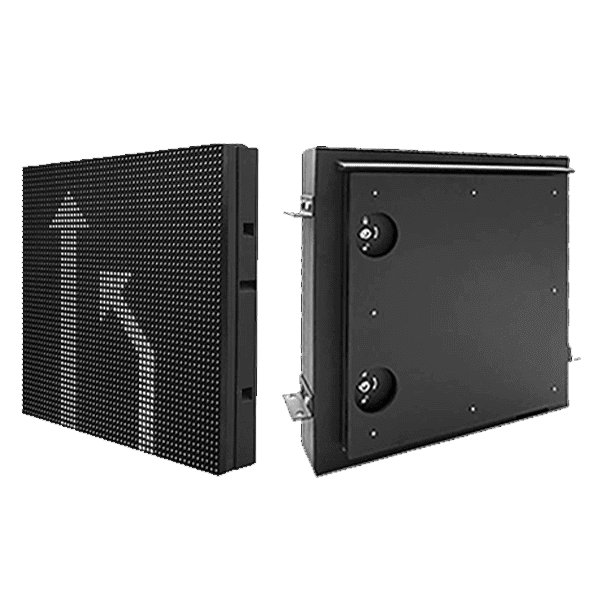

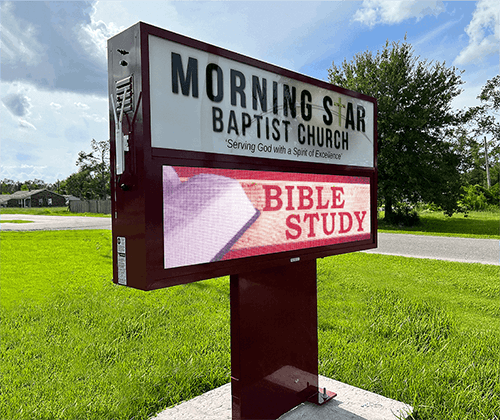

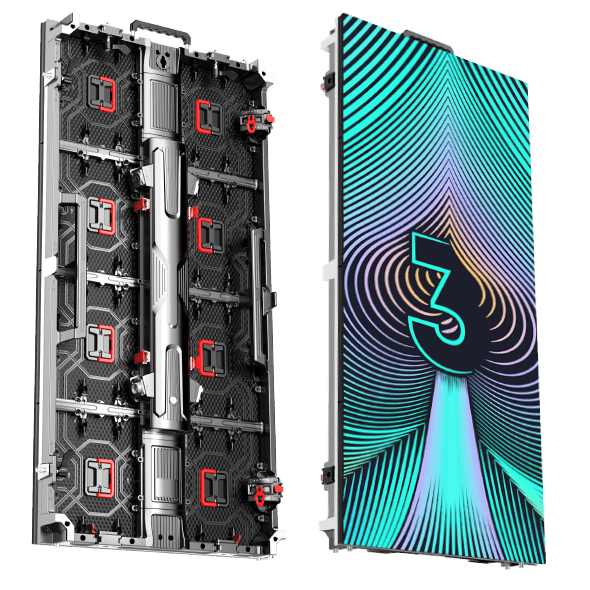

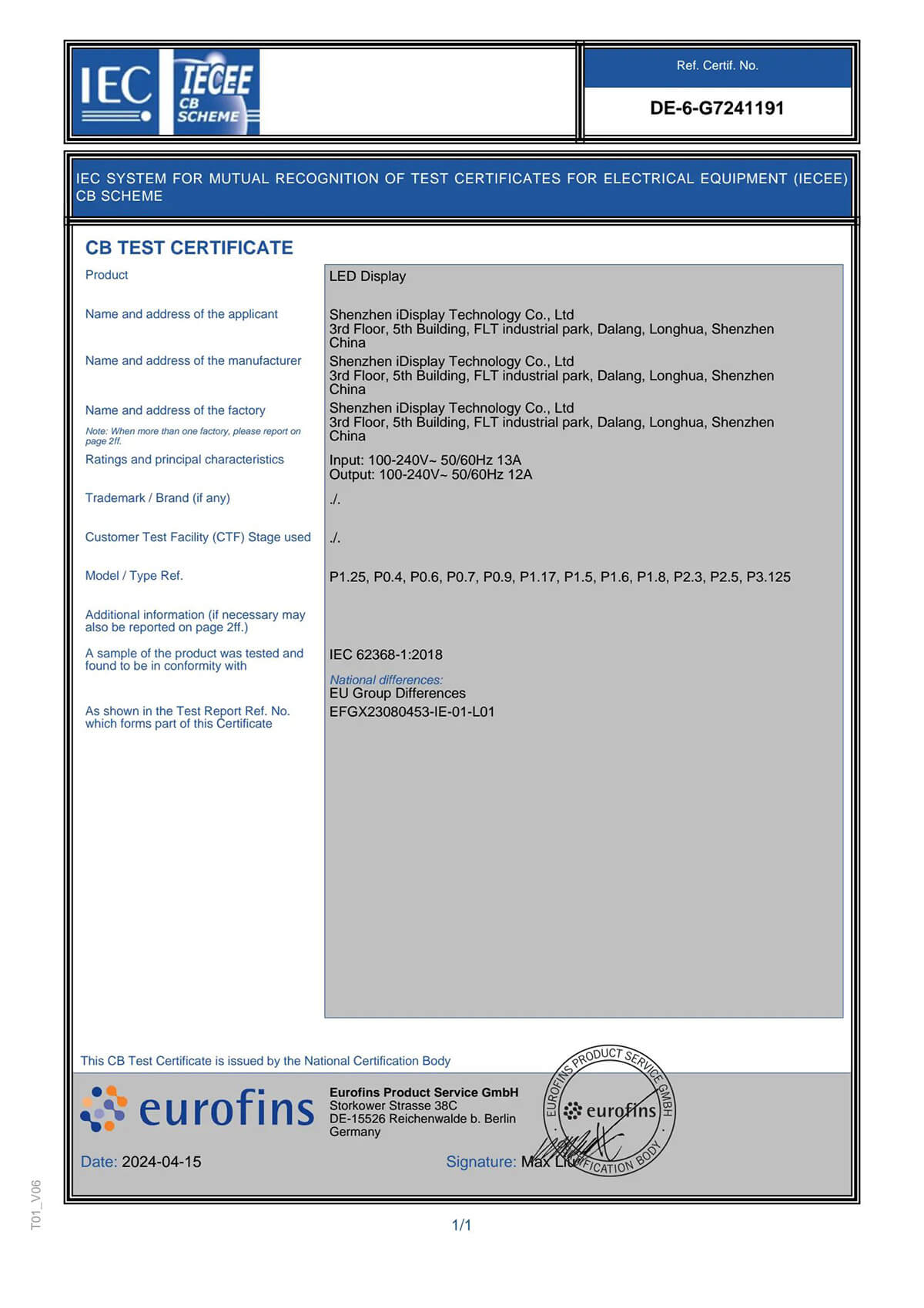

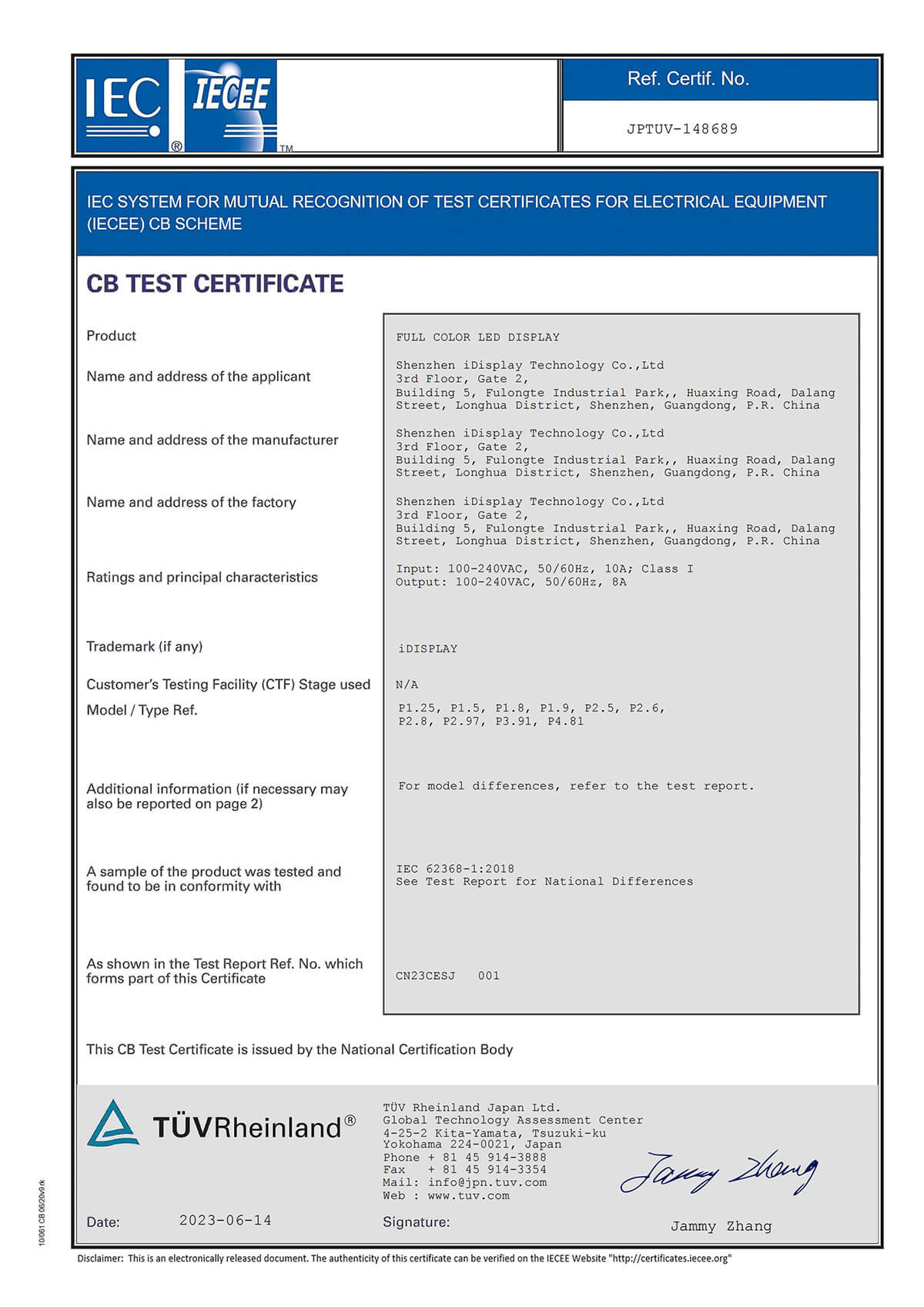

iDisplay LED display manufacturer vendor was founded in 2018 with a passion for the LED display industry. Headquartered in Shenzhen, China with a factory in Huizhou, China. iDisplay is a quality-oriented corporate which possesses strong manufacturing capability, advanced production equipment, professional technical force and efficient R&D team.

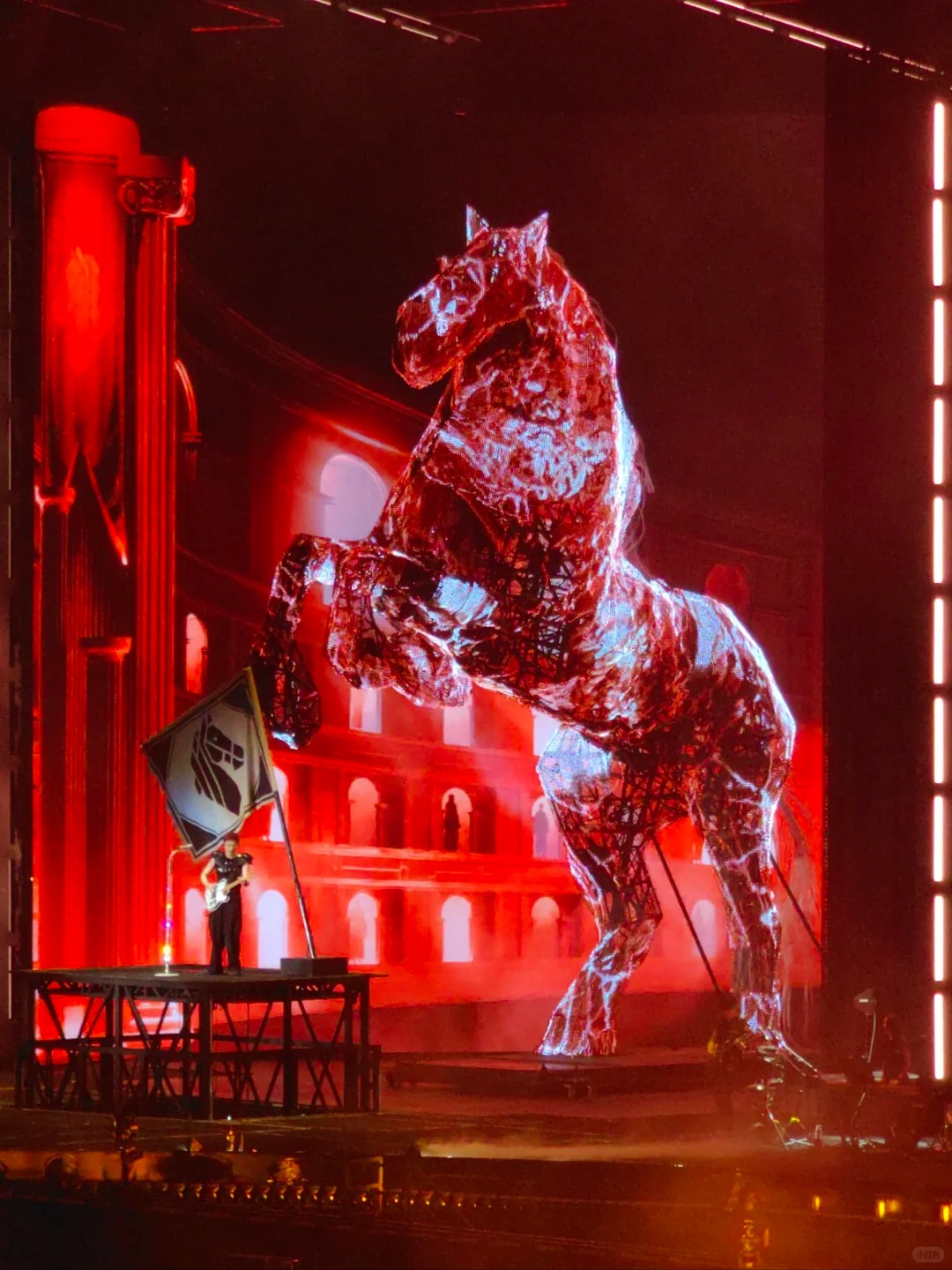

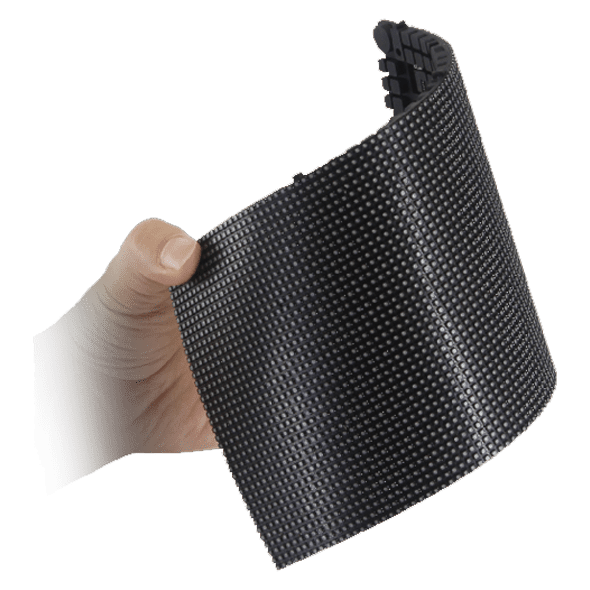

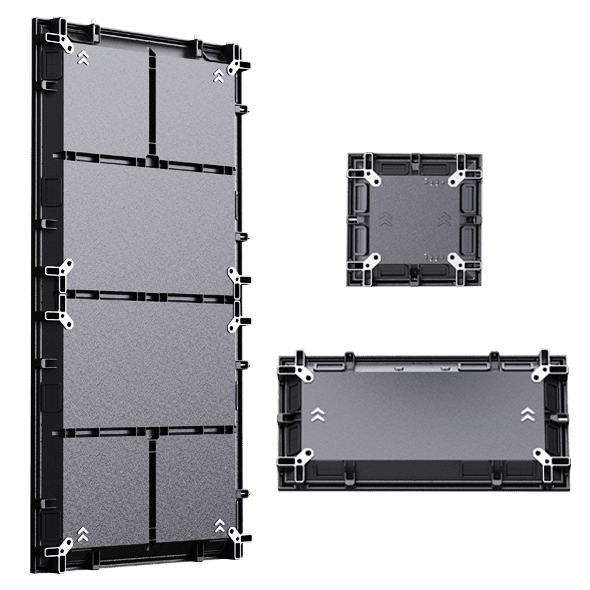

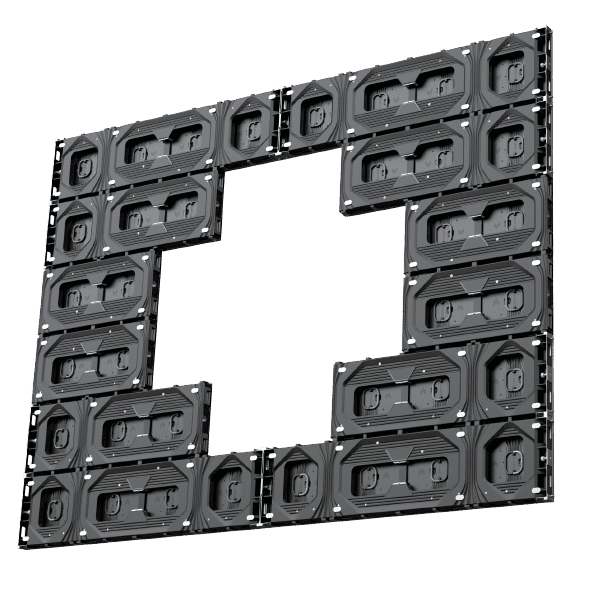

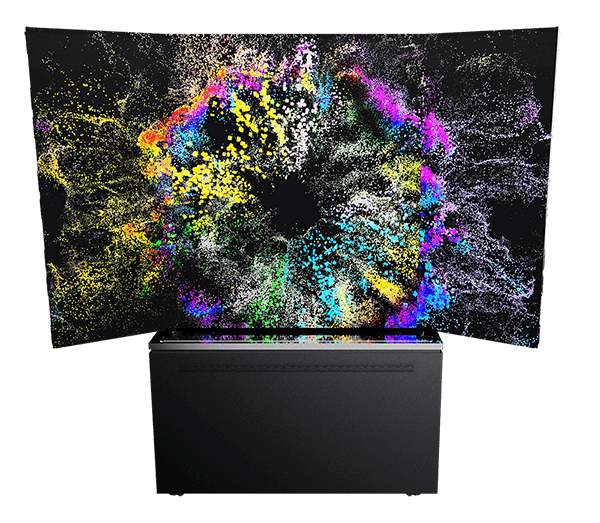

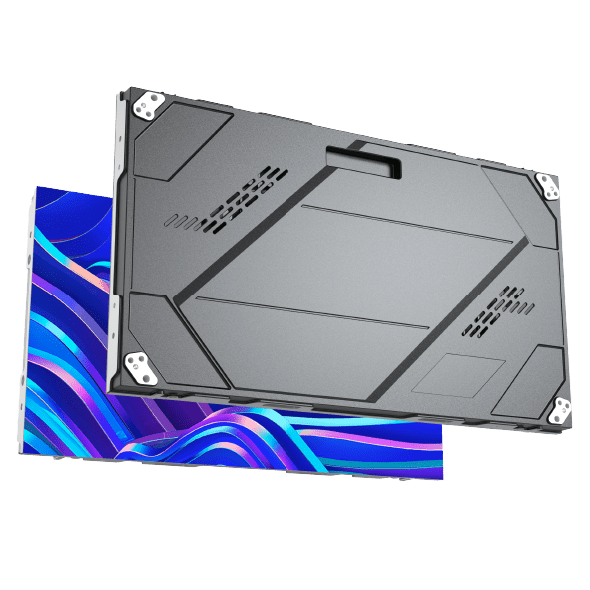

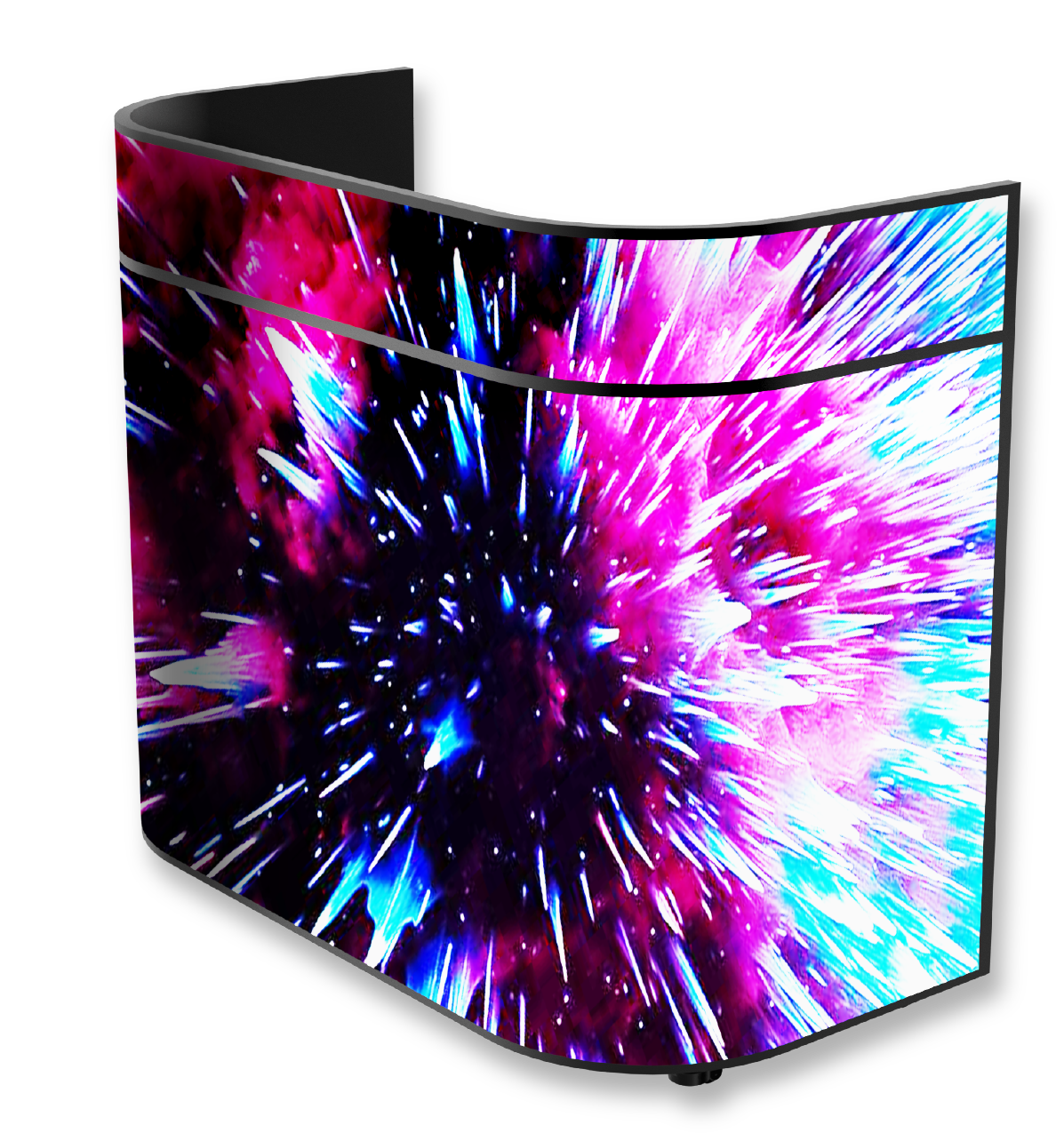

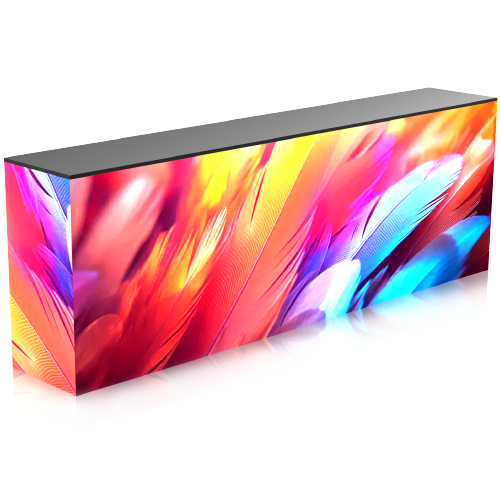

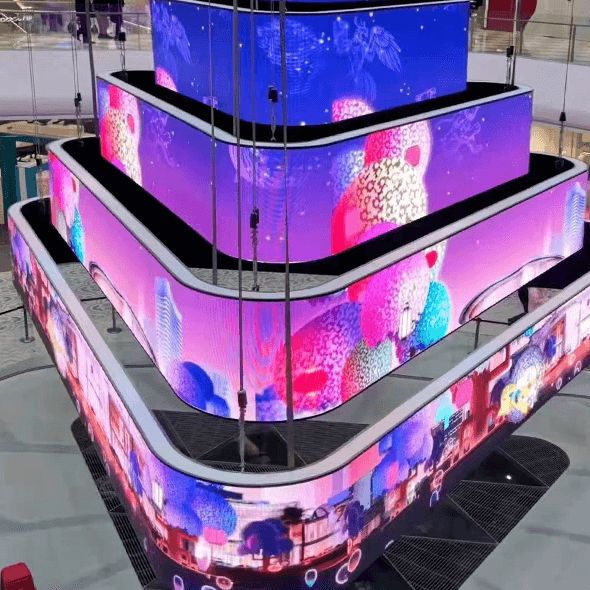

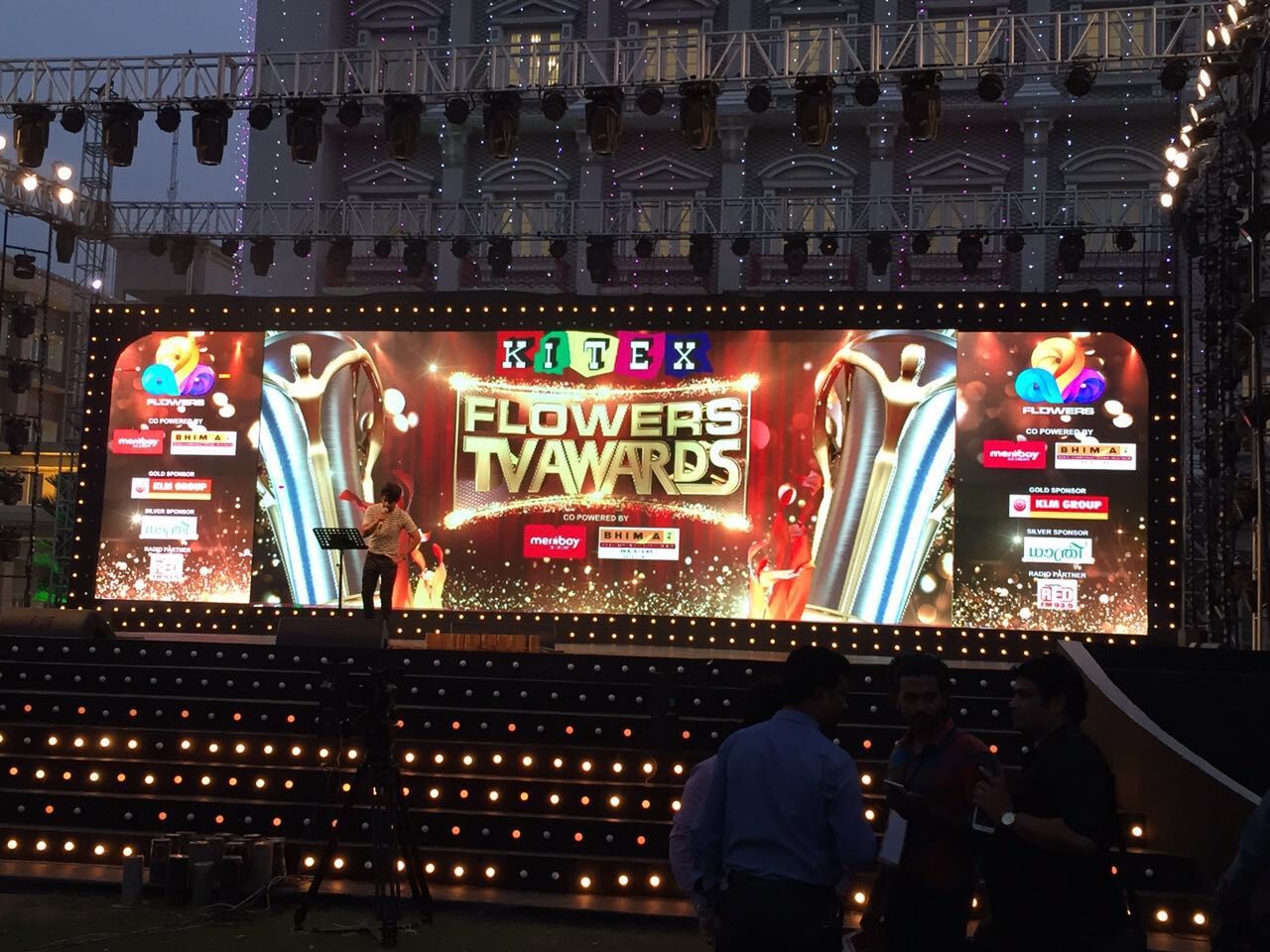

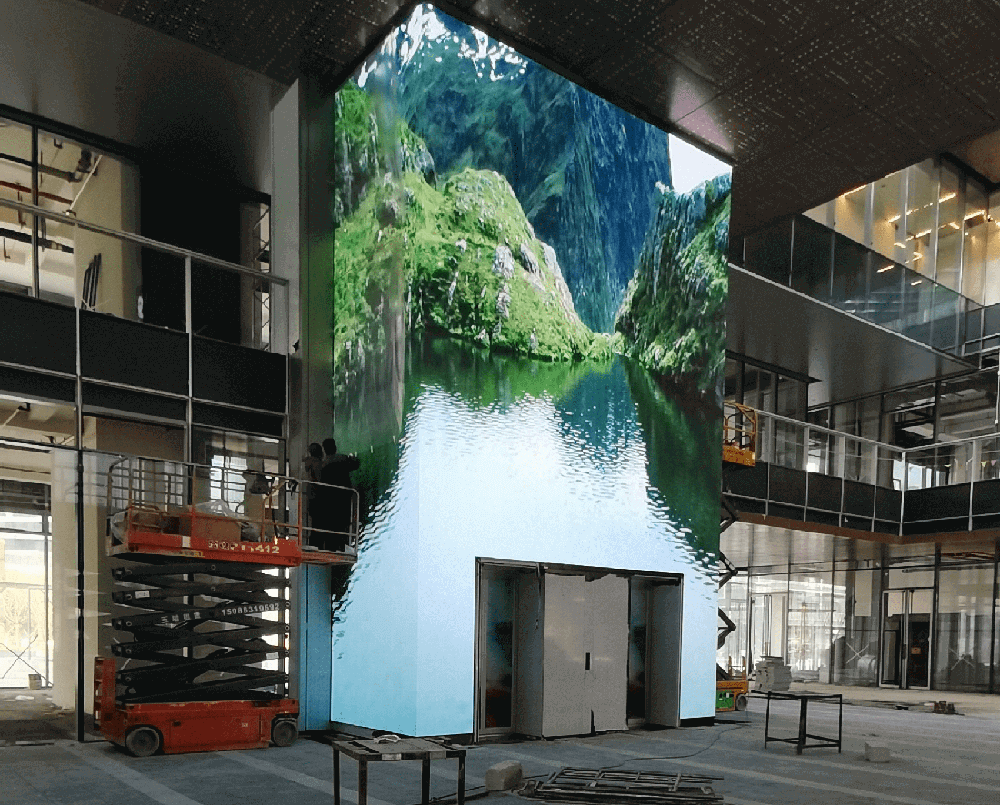

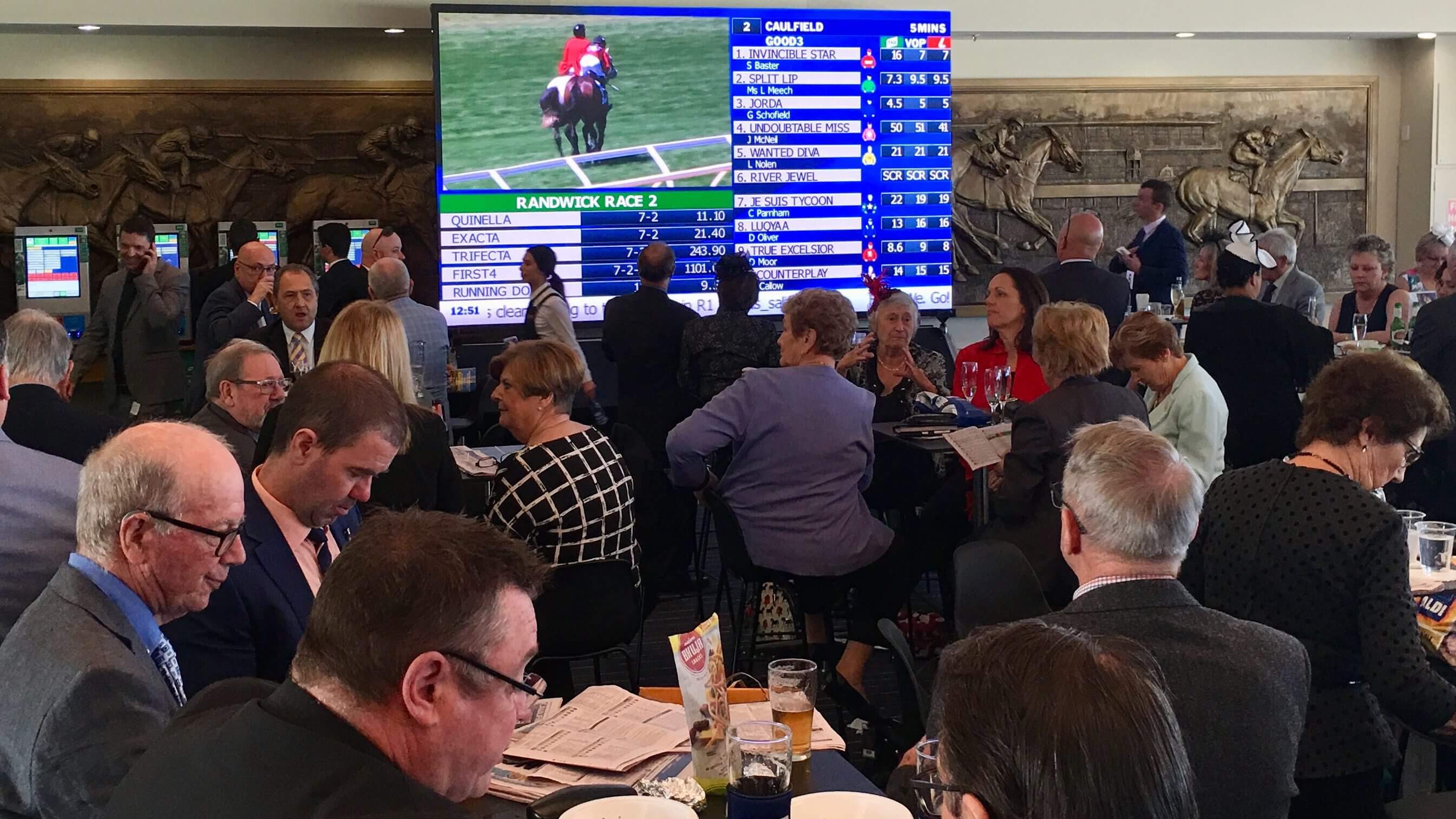

We devoted ourselves to design and manufacture led displays for commercial and retail field such as Chain store, shopping mall, transport hub, meeting room, immersive experience hall, XR stages, film studios and broadcast site etc. Our product is widely used in a lot of countries and regions and function well in various of applications and environments as we have extensive experience in OEM and ODM.

Our final goal is to build up long-term cooperation partnership with our clients. We are pursuing our dream of building “iDisplay” into a world-renowned brand that can helps hundreds of or even thousands of local led display wholesalers or contractors to serve for their end users with quality product and delicate service.

Values:

● Customer first

● Keep creating values and delivering values to customers and society

● Today’s best performance is tomorrow’s baseline

● Trust makes everything possible

.jpg)

.jpg)

.jpg)

.jpg)